At RemoFirst we believe in constantly improving our product to make the experience better for our customers. Today, we are announcing several new features that you can now access on our platform, and, of course, some bug fixes. :)

EOR

#1 - Create recurring additional payments

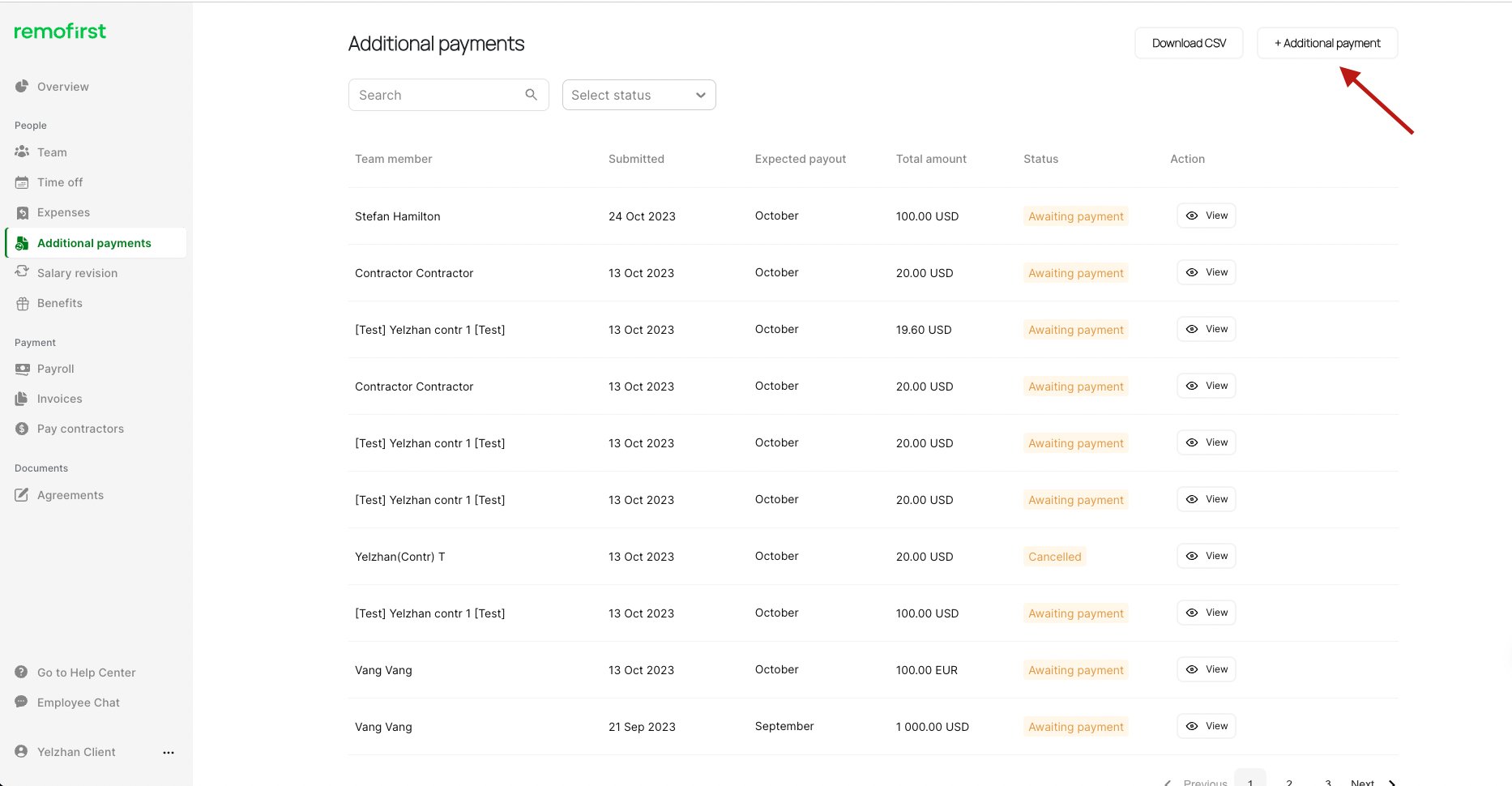

To add an additional payment, select the + Additional payment button in the top right corner.

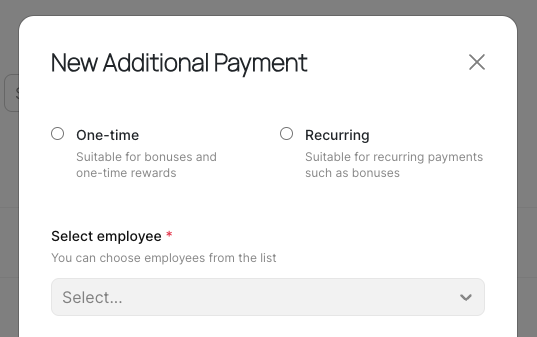

1. Select who you want to pay

2. Select your payment frequency

- Select One-time if you want to add a one-off payment on a specific month. Select Recurring if you want to make recurring monthly payments for a set period.

3. Complete relevant payment details:

- Select the payment type, amount, currency, name, and description. You can enter the amount in your account currency or your team member's currency.

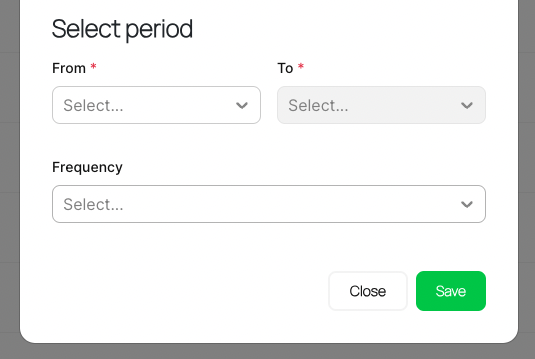

4. Set your payment period and frequency

- Select the month from which these payments should start and end

Note: Any additional payments added after the cut-off date of the 3rd working day of the month, will be added to the next payroll cycle.

In order to make additional payments in the immediate month, requests must be submitted by the cut-off dates. For example, if you want to include a recurring additional payment for September, this must be submitted before the cut-off day of the 3rd working day.

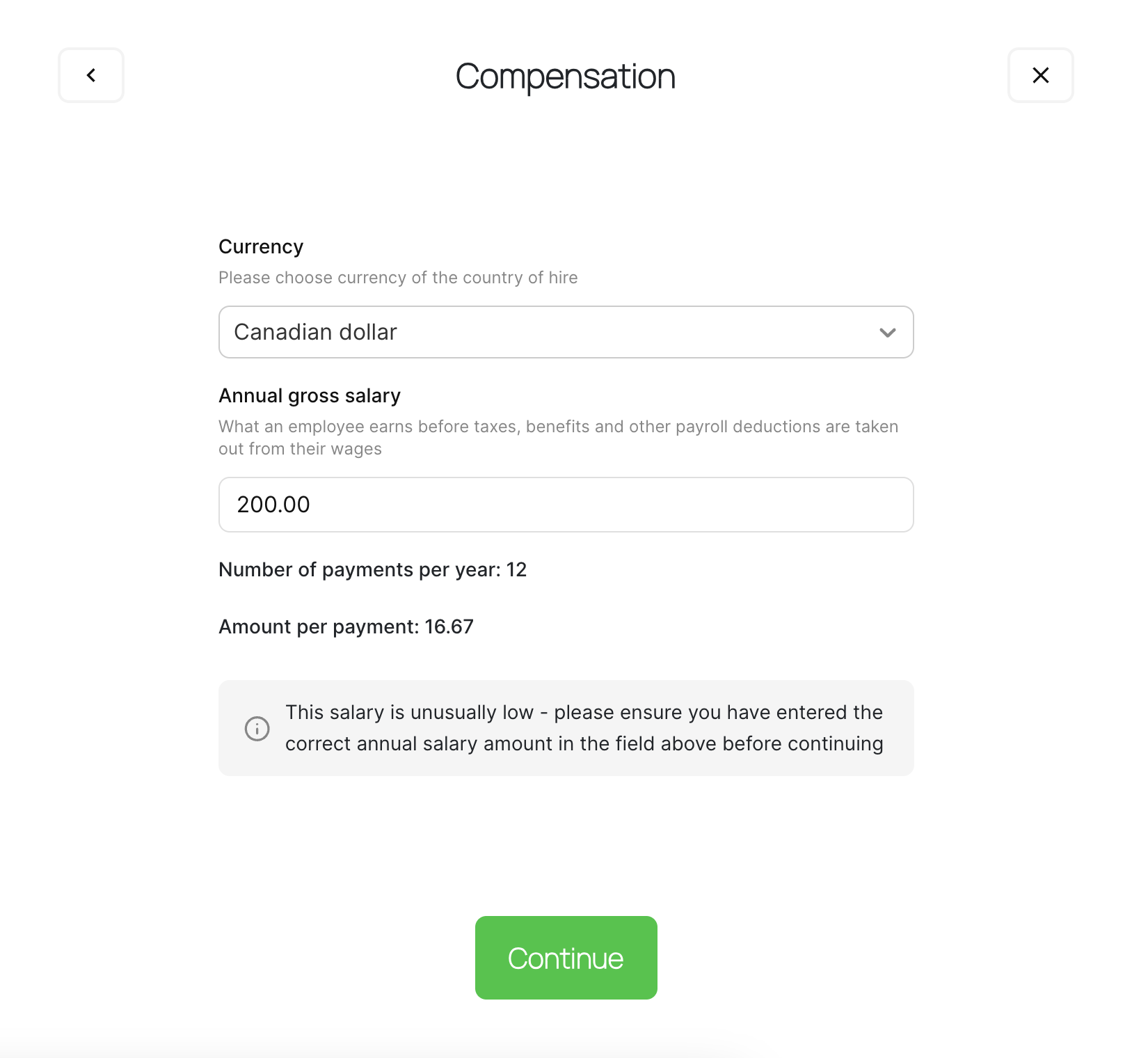

#2 - Warning Message and logic if Client inputs an unusually low salary for Employees

To ensure that we minimize potential mistakes during onboarding, we now display a warning message when you (the Client) enter a salary amount that falls below a predetermined benchmark ($200/month or equivalent). This is done so we can avoid mistakes and ensure accurate data entry regarding employee salaries.

#3 - Auto notifications for Clients about Employee contract expiration

We now send out auto-generated reminder emails which are sent at intervals of 15 days, starting 60 days before the contract expiration date, with a final reminder email to be sent 1 day before the contract expires.

We hope these reminders help you in keeping abreast of any contractual and time-sensitive obligations you might have.

You do not have to action anything on your end, these will trigger automatically.

#4 - Revamping our Client Help Center and ways to reach us

We are working to streamline how we provide assistance, and this means revamping our self-help articles and the ways in which you can reach the team for human intervention.

Our new Help Center will now serve as our single source of truth and is routinely updated to include the most accurate information.

You can now access the Help Center via the Platform.

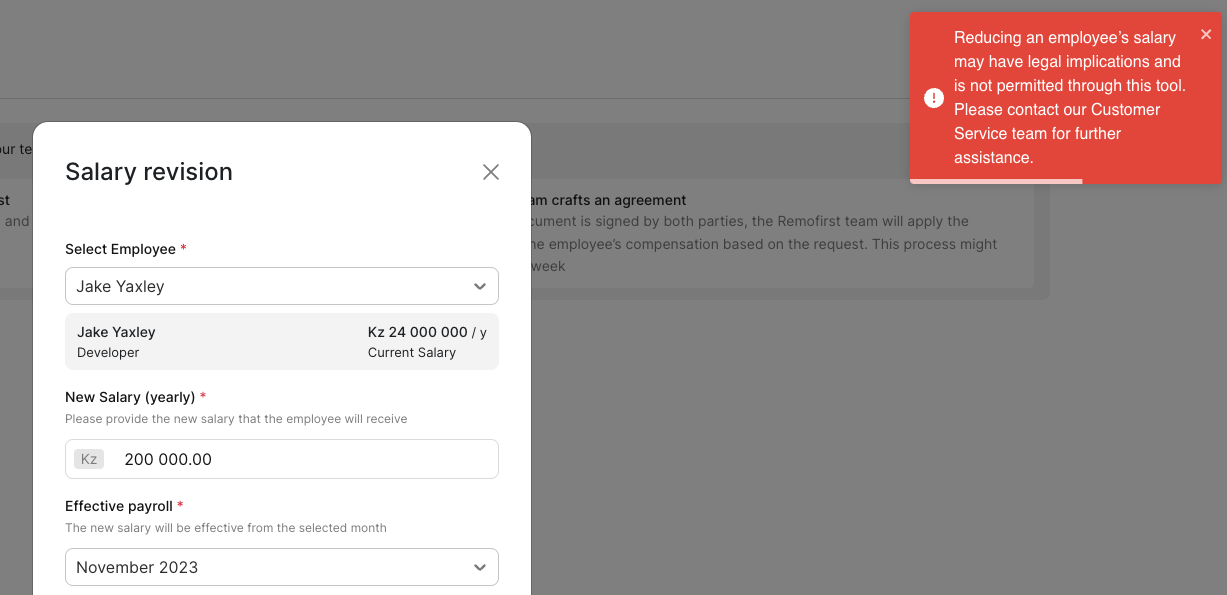

#5 - Clients are no longer able to lower/reduce an employee’s salary using the Salary Revision tool within the platform, and are shown a “Contact CS” pop-up instead

To adhere to legal standards and to prevent potential misuse, we have implemented a restriction within the Salary Revision tool in the Client app.

If a salary revision (reduction in salary amount) is attempted, a pop-up will direct you (the Client) to contact our Customer Success (CS) team for further assistance.

This feature aims to ensure compliance within the legal frameworks in various countries where reducing an employee's salary without proper justification is typically a breach of regulations.

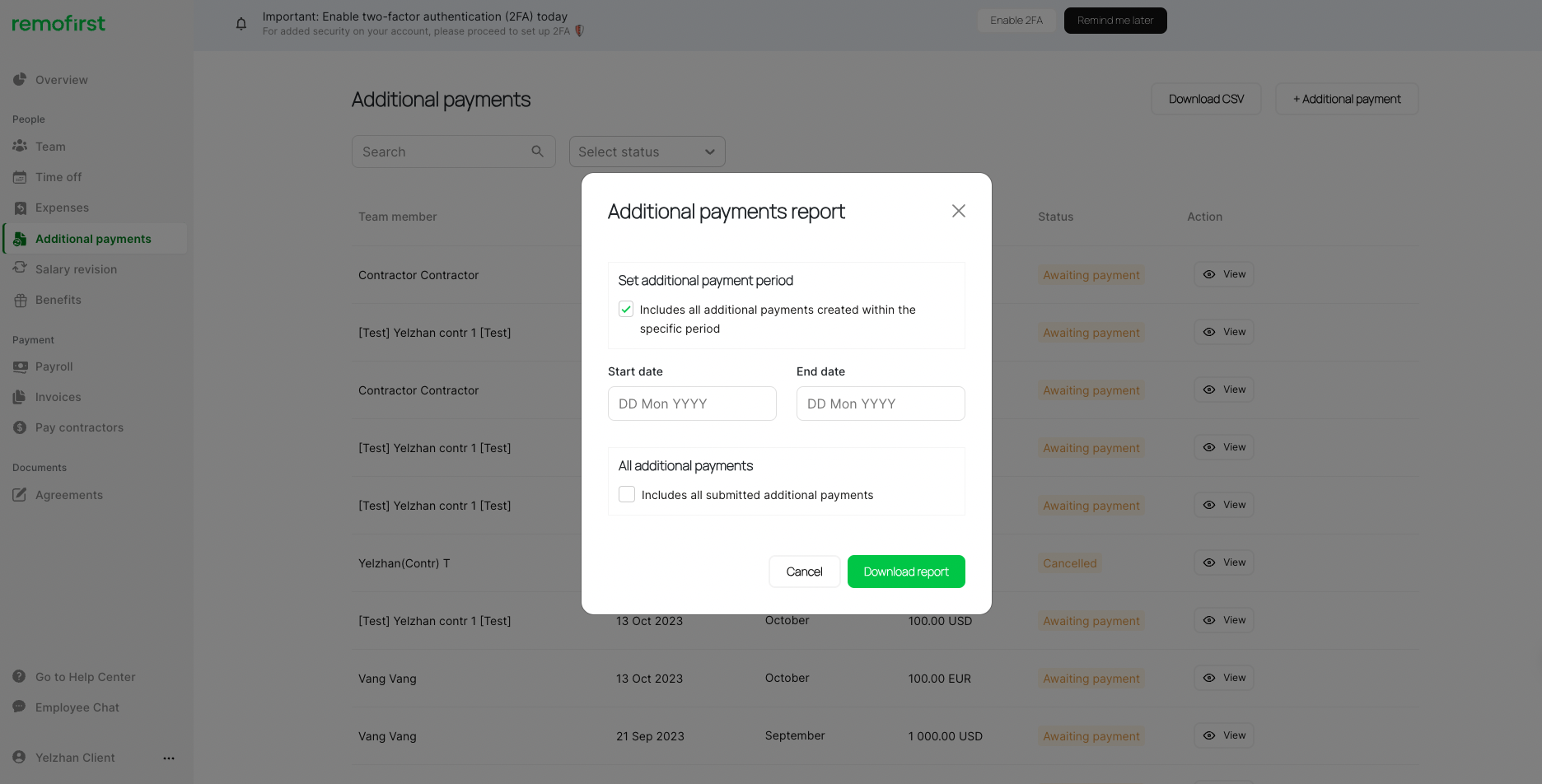

#6 - Clients can download additional payments report

You can download a report of all additional payments, to track all your additional payments made to employees.

Select the download button and you will have two possible reports which you can generate:

- Download all additional payments for employees; and/or

- Download for a specified period

#7 - Warning message for employees who do not enter any expiry date for their work permit during onboarding

During onboarding, if an employee checks the “Yes” button when asked if they require a work permit, but does not check the “I have the required work permit or visa” option, they are now shown a message telling them that in order to begin their employment in the country, they must have their documents ready and provide a valid work permit expiry date.

- “You have indicated that you require a work permit or visa in order to be employed in your country of residence, but you have not indicated that you have the required documents. You must have your work permit or visa documents ready to upload so that our local team can approve them, and you must enter the expiry date of your work permit or visa here before you complete your onboarding.”

Contractor Payments

Client App

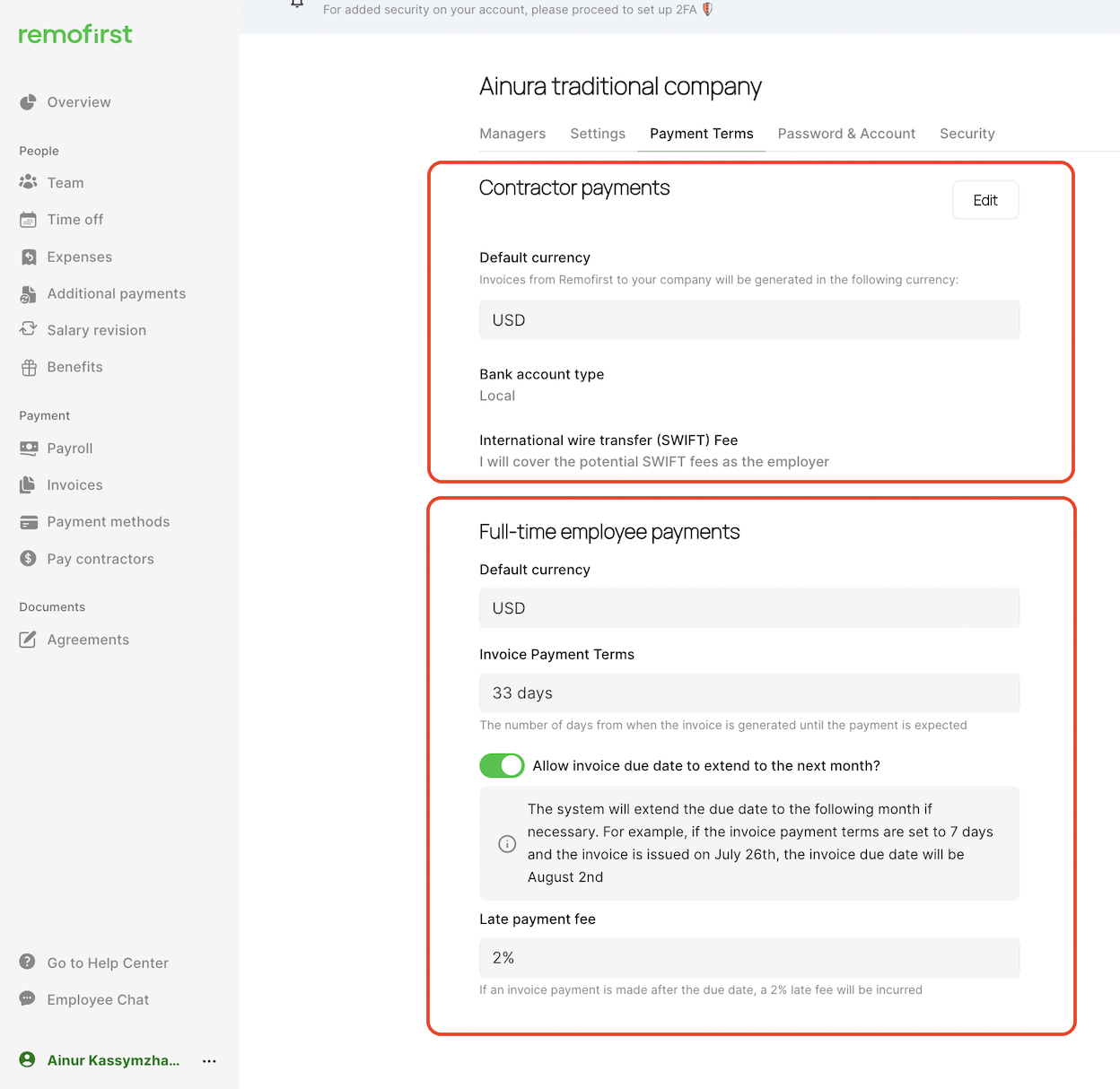

#1 - Payment terms section organized to categorize payment terms for Contractors and Employee management

Introducing changes in the Client profile settings - Payment terms section:

Now you can see categorized Payment terms for Contractors payments and for Full-time Employees

#2 - Payments terms for Contractors, additional fields and options added to the Client profile (Payments terms tab)

You now have new fields which can be accessed on the platform’s Payment Terms tab

These options allow you (the Client) to choose how you wish to handle the SWIFT fees associated with your Contractor payments.

1. “Default Currency" for Contractor payments, which automatically prefilled based on the your (Client) country

2. "Bank Account Type" (Local or Global) that dynamically displays options based on the selected default currency - you (the Client) now have an option to edit this field

3. International wire transfer (SWIFT) Fee

- Current Situation: We have transitioned to a new payment provider, Nium, and have introduced a fixed SWIFT fee of $20 USD for transactions related to contractor payments. At present, this fee is deducted from the Contractors' final payout.

- Updated Situation: We now offer you (the Client) three configuration options when setting up your accounts for contractor payments.

- Set default settings for all your Contractors from your profile settings.

- Set customized settings for specific Contractors directly from their individual profiles.

Option 1: "I will cover the potential SWIFT fees as the Employer."

- $20 SWIFT fee will be added to the aggregate invoice for each contractor with receiving currency = USD.

- Contractors will not have any SWIFT fee on their sub-invoice.

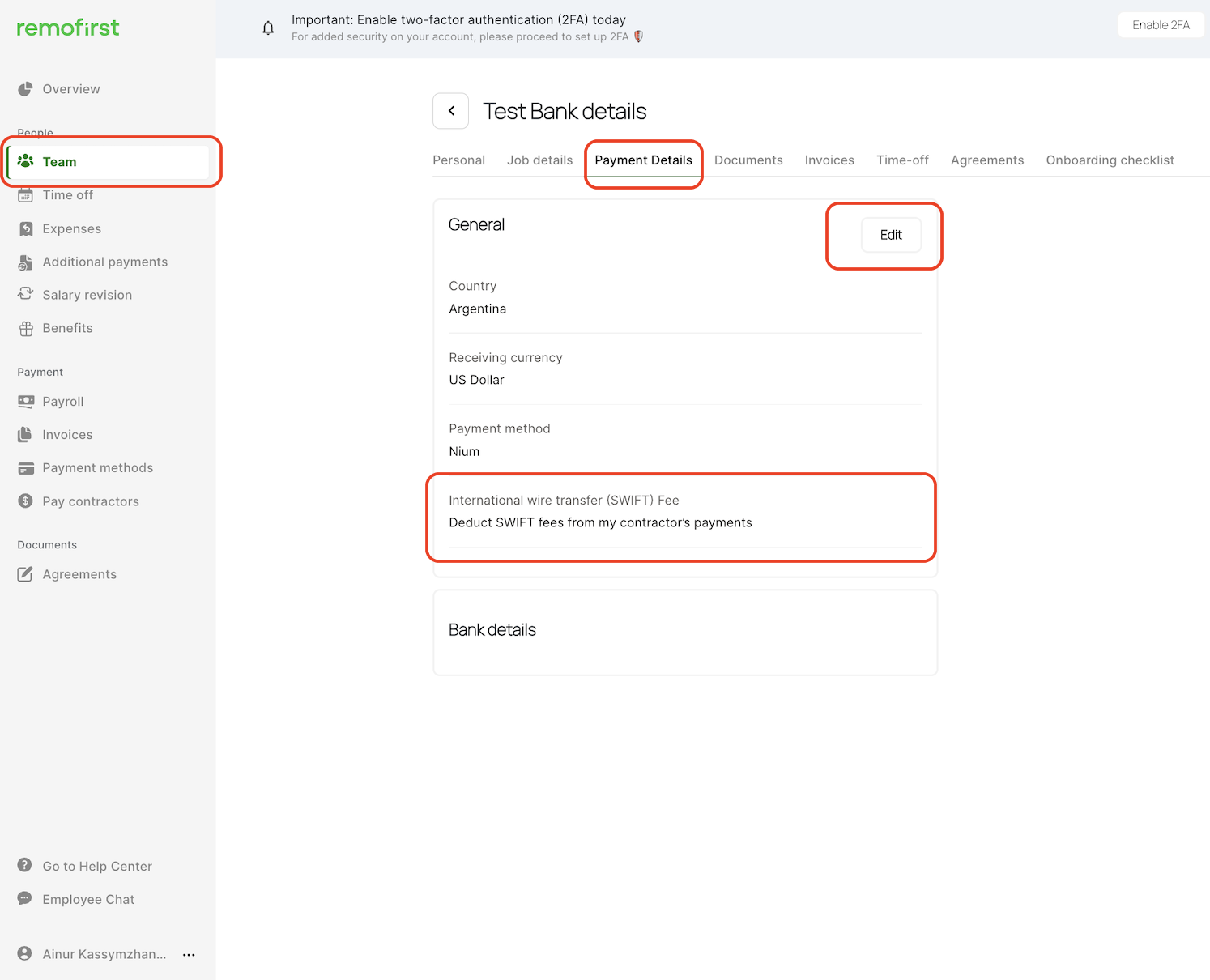

Option 2: "Deduct SWIFT fees from my Contractor’s payments."

- When a contractor selects USD as their receiving currency, they will incur a SWIFT fee of $20.

- The aggregate invoice for you will not include the $20 SWIFT fee.

- The contractor's sub-invoice will display the deduction of $20 SWIFT fee from total amount.

Option 3: “Split SWIFT fees between me and a contractor 50:50.“

- The aggregate invoice for the client will be automatically increased by $10 for the SWIFT fee per contractor with receiving currency = USD.

- The contractor's sub-invoice will include a deduction of $10 SWIFT fee.

4. "Default Currency" for Full-time employee payment, which is automatically prefilled based on your (the Client) country

You (the Client) have an option to modify only 2 fields:

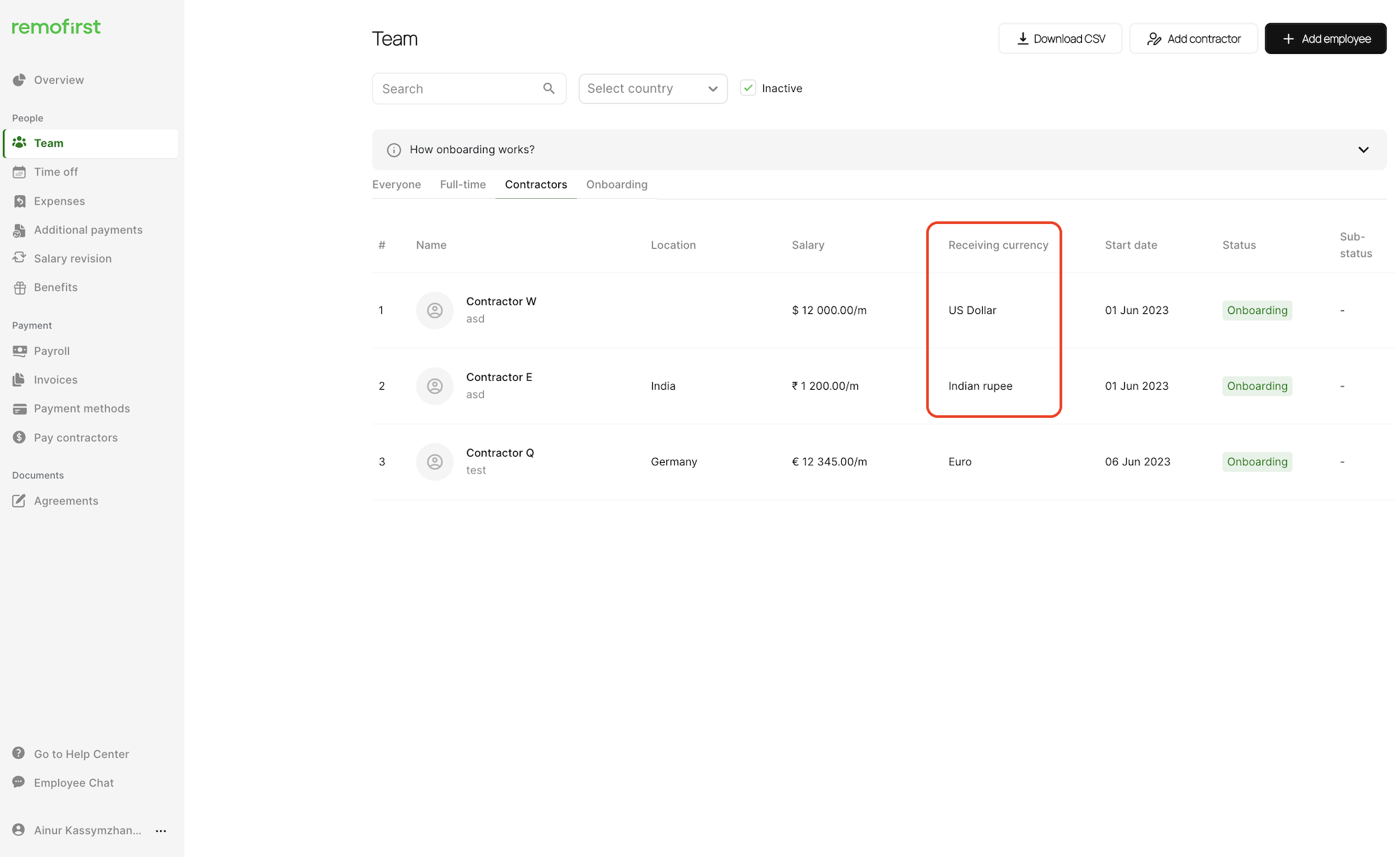

#3 - Display receiving currency information for Contractors

In the 'Team' section, we are introducing the feature to display receiving currency information for your Contractors.

This addition is designed to enhance transparency in payout configurations. When the local currency is selected, there are no SWIFT fees; however, when USD is chosen as the receiving currency, SWIFT fees will be incurred.

#4 - Contractor service fee now can be included in the aggregated invoice.

- Current Situation: The system previously issued distinct invoices for Contractor payment service fees, separate from the aggregate invoice.

- Updated Situation: We've added a flexible configuration option. You can now choose to include Contractor payment service fees in the same aggregated invoice or receive them as separate invoices, providing you with more control and convenience.

Contractor App

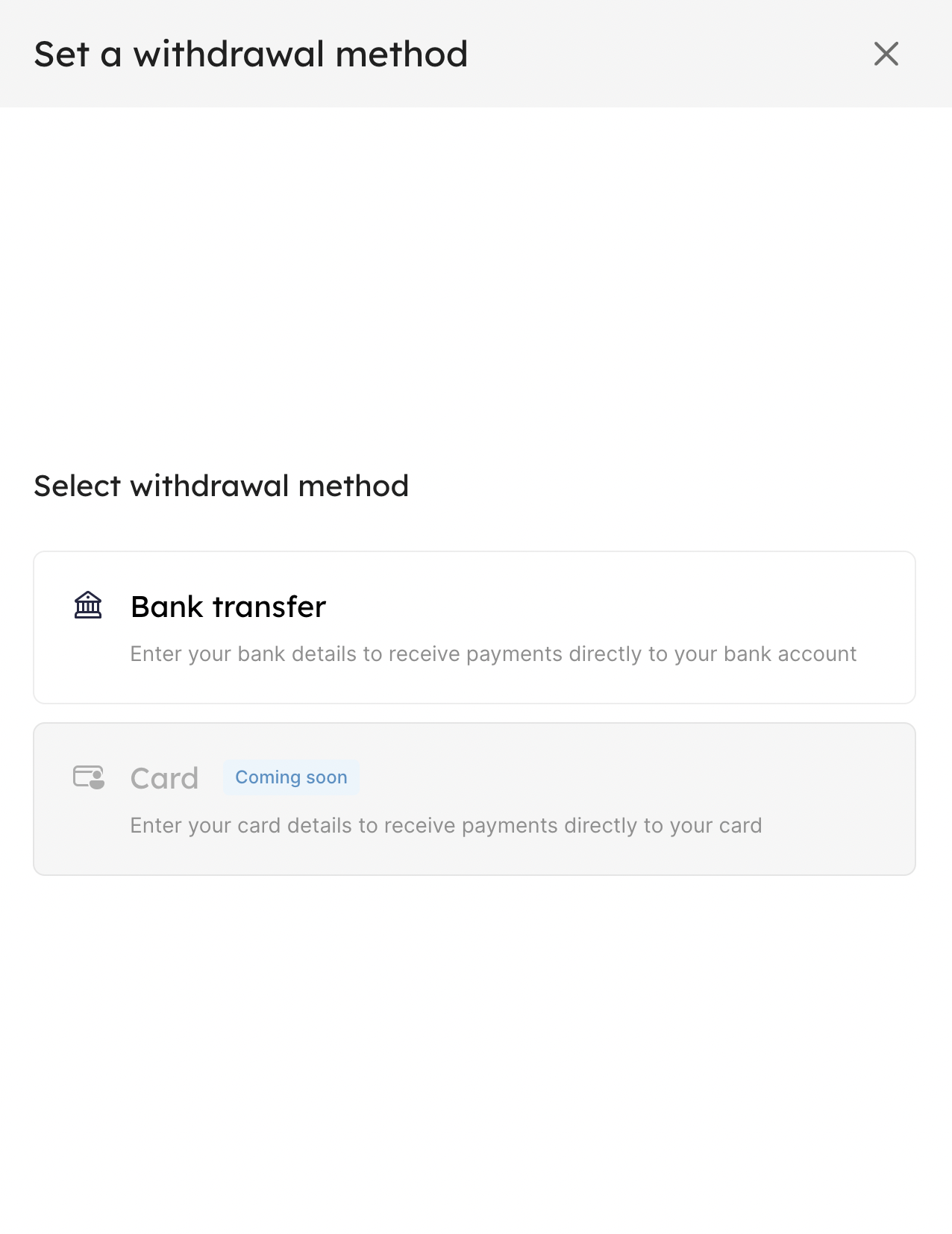

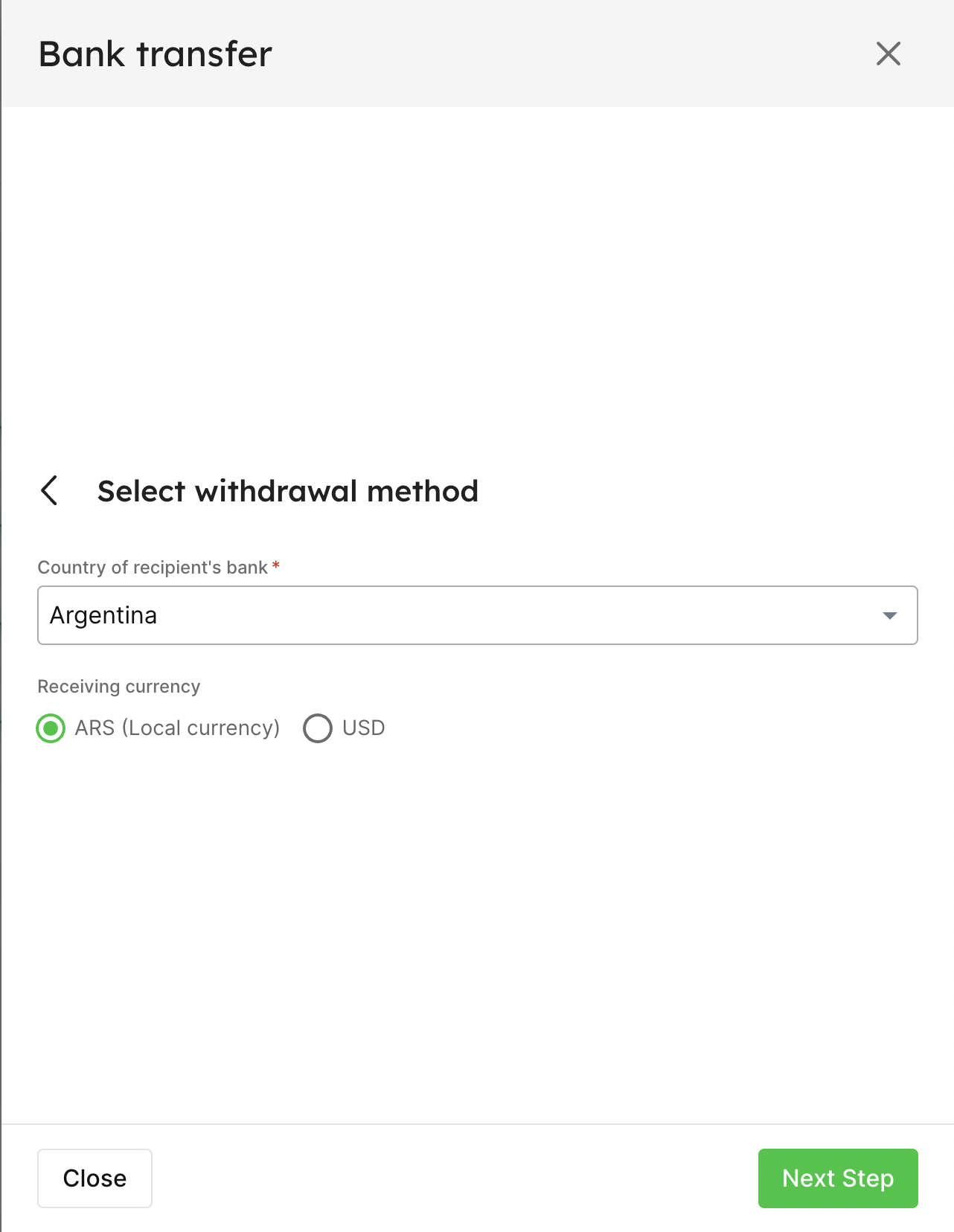

#1 - Introducing an enhanced withdrawal method setup process for individual Contractors that simplifies the experience and reduces payout errors

A. Bank account country selection - Introducing Dropdown menu listing supported countries for payout transactions.

B. Upon selecting a country, our system provides you the supported receiving currency options and adjusts account details to align with the payment provider's specific requirements for that location.

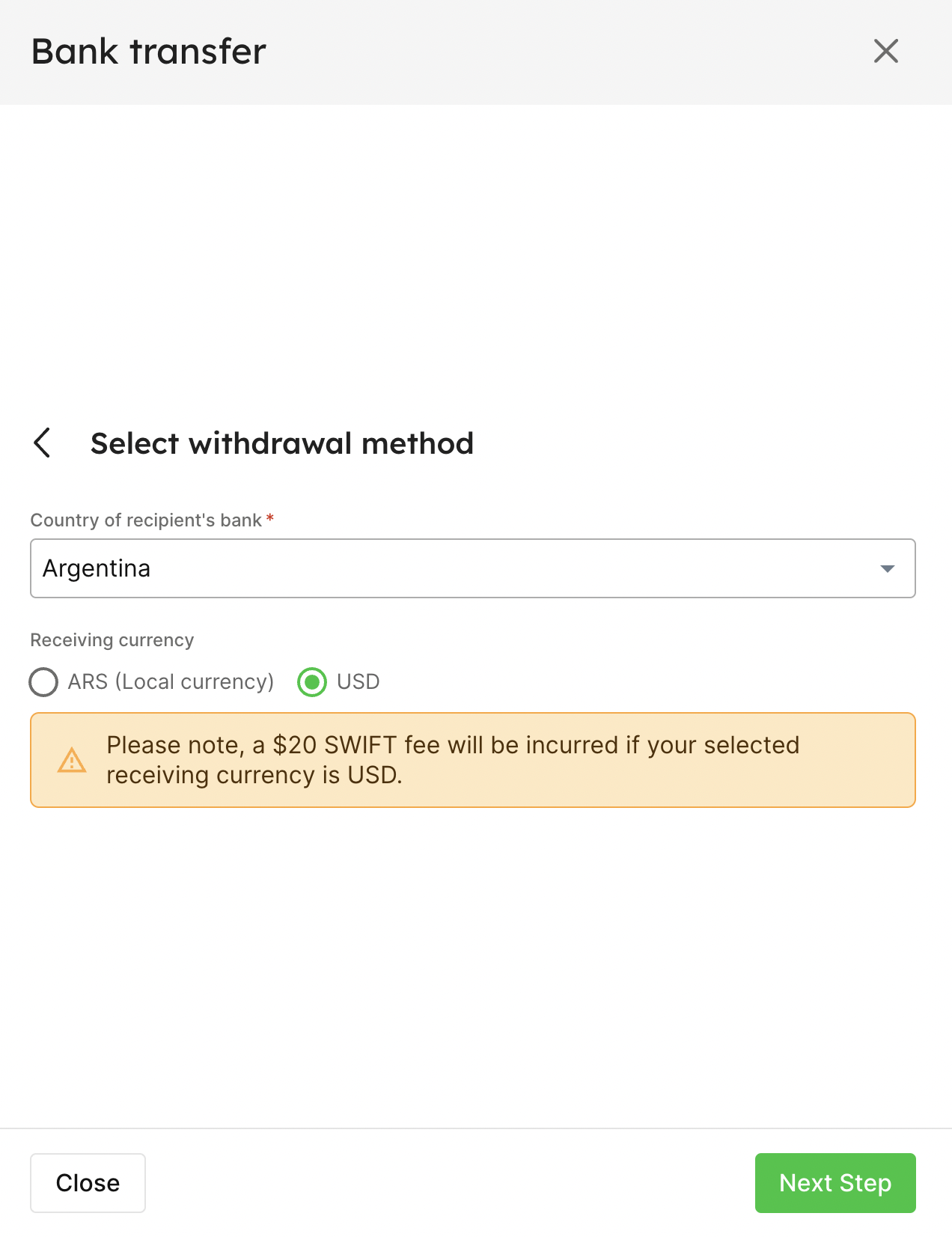

C. Dynamic, informative SWIFT fee explanations for wire transfers transactions (currency: USD).

- If your Employer selected the option for the swift fee to be covered by the contractor (you), you'll see the following message: 'Please note, a $20 SWIFT fee will apply if you choose USD as the receiving currency.'

- If your Employer selected the option for the swift fee to be shared equally (50:50) between the contractor (you) and client (your employer), the following message will be displayed: 'Please note, a $10 SWIFT fee will apply if you choose USD as the receiving currency.'

- If your Employer selected the option for the swift fee to be covered by them, SWIFT fee explanations will not be displayed.

This will help to minimize payout errors by ensuring you provide precise, country-specific bank details and to elevate the overall payout experience.

.png)

.png)